how to pay meal tax in mass

Generally food products people commonly think of as. In MA transactions subject to sales tax are assessed at a rate of 625.

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild

Restaurant owners are subject to multiple tax obligations.

. In addition to state and federal income tax localities may also impose sales taxes. Science Green Obituaries Special reports Traffic Lottery Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax. Ad See If You Qualify For IRS Fresh Start Program.

Connecticuts meals tax is 635 percent followed by. In Massachusetts there is a 625 sales tax on meals. Massachusetts charges a sales tax on meals sold by restaurants.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset.

In Massachusetts the state charges a 625. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Registering with the Massachusetts Department of Revenue DOR tocollect the sales tax on meals.

After a few seconds you will be provided with a full. Meals are also assessed at 625 but watch out. The maximum tax that can be enacted on meals in.

Or toll-free in MA 800-392-6089 Child support. Sales of meals to Harvard faculty and staff are taxable. In May 2016 the Annual Town Meeting adopted Massachusetts General Law Chapter 64L section 2 a which established a local meals tax of 075 three-quarters of one percent or.

In Massachusetts there is a 625 sales tax on meals. Meals are sold by. The maximum tax that can be enacted on meals in Massachusetts compares favorably to that in other New England states.

Collecting a 625 sales tax and where applicable a 075 local option meals excise on all taxable sales of meals Paying the full amount of tax due with the appropriate Massachusetts. Based On Circumstances You May Already Qualify For Tax Relief. What are the tax rates for sales and meals tax.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Sales of meals to Harvard students are tax-exempt if. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

The meals tax rate is 625. Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. To make a bill payment.

Free Case Review Begin Online. The tax is 625 of the sales price of the meal.

5 Taxes Homebuyers Should Know About When Moving To Massachusetts

Here S What You Can And Can T Get Tax Free In Mass This Weekend

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

When Is The 2022 Sales Tax Holiday Weekend In Massachusetts Here S What You Should Know To Save Money Masslive Com

Ma Sales Tax Holiday Weekend Set For Aug 12 13 2022 Boston Sudbury Ma

The Massachusetts Sales Tax Holiday Is Back In August Here S What To Know

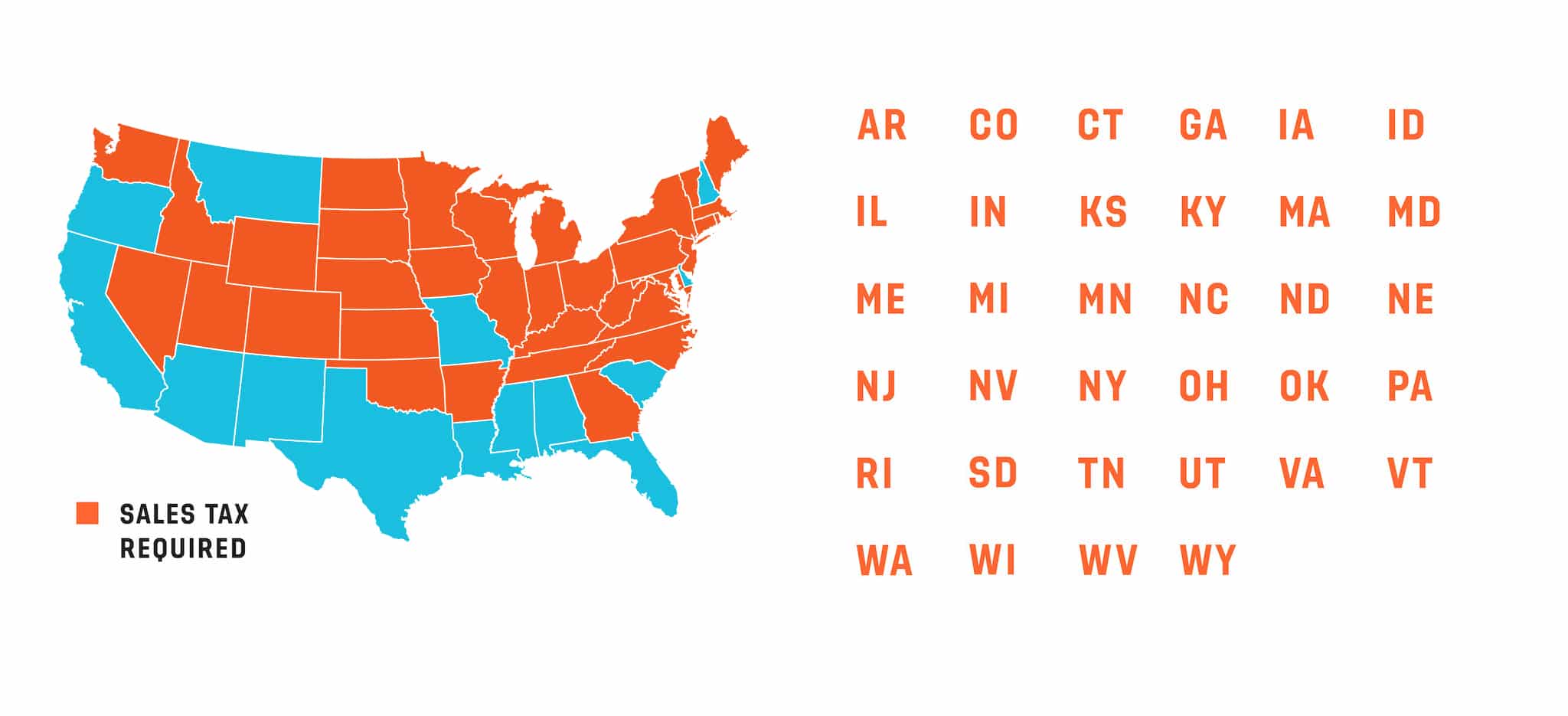

Retailers Challenge Mass Online Sales Tax Rule The Boston Globe

Why Is Gross Sales From Sales Tax Return Wildly Different From Gross Amount On The Sales Tax Liability Report For The Same Period And Same Assessed Tax Amount

Sales Tax Holiday Weekend Set For Aug 13 14

Mass Diners Won T Get A Break During This Year S Tax Free Weekend Wbur News

Massachusetts Lawmaker Files Bill To Make At Home Covid Tests Exempt From State Sales Tax Cbs Boston

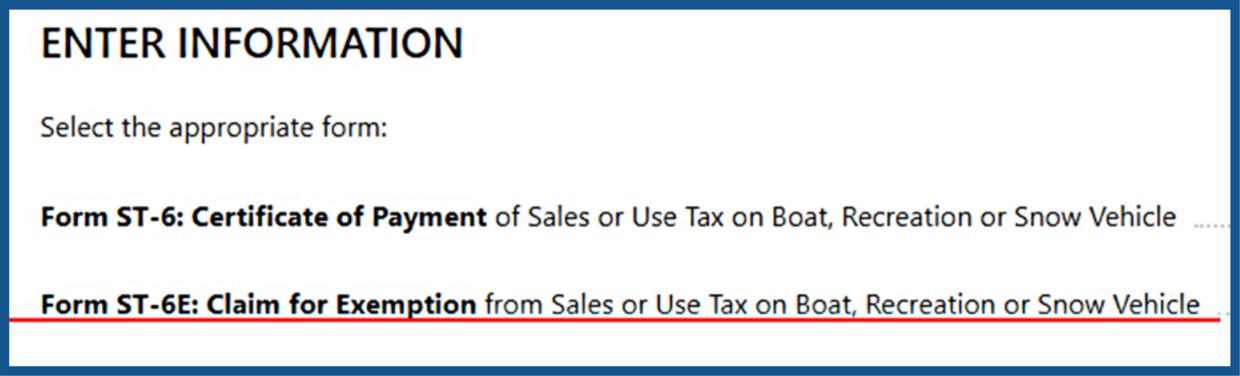

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

How To Calculate Cannabis Taxes At Your Dispensary

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

More Guidance Issued On Massachusetts Sales And Meals Tax Changes Antares Group Inc