income tax rates 2022 australia

Tax rates and codes You can find our most popular tax rates and codes listed here or refine your search options below. In addition foreign residents do not pay the Medicare Levy or receive the Low Income Tax Offset LITO.

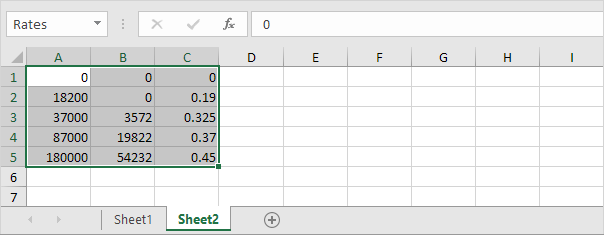

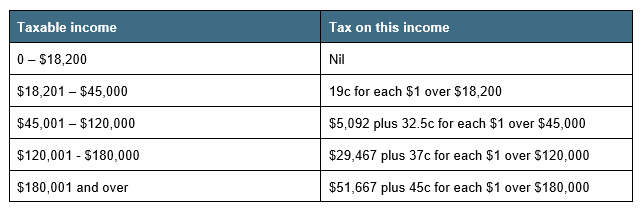

Tax Brackets Australia See The Individual Income Tax Tables Here

Credit unions with a notional taxable income of at least 50000 but less than 150000 are taxed on their taxable income above 49999.

. Tables sets out the PIT rates that currently apply to resident and non-resident individuals for the year ending. The maximum tax offset of 70000 applies if your taxable income is 3700000 or less. The new tax treaty the.

Personal Income Tax Rate in Australia averaged 4544 percent from 2003 until 2020 reaching an all time high of 47 percent. From 1 July 2022Check the fuel tax credit rates from 1 July 2022. However for companies with an aggregate annual turnover of less than AUD 50 million that derive no more than 80 of their.

The Income tax rates and personal allowances in Austria are updated annually with new tax tables published for Resident and Non-resident taxpayers. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to. It also raises the threshold for the 45 marginal tax rate meaning everyone earning between 45000 and 200000 will pay the same 30 tax rate.

The corporate income tax rate generally is 30. The Tax tables below include the. Australian income tax rates for 202122 and 202223 residents Income thresholds Rate Tax payable on this income.

Australian tax brackets and rates 2022. Credit unions with a notional taxable income of. Australia and Iceland have signed a new tax treaty which following its entry into force will represent the first tax treaty between the two countries.

To understand how much tax you may need to pay youll first need to look at the current income tax brackets and rates as listed on. If you have details on these tax tables and would like them added to the Africa Income Tax Calculator please send a link or the details for the 2623 - 2624 Tax Year to us and we will add. Checklist - tax return 2022 Checklist - supplement 2022 Amendment requests 2022 Tax return Income questions 1-12 1 Salary or wages 2022 2 Allowances earnings tips directors fees etc.

A base rate entity for an. Make sure you click the apply filter or search button after entering. A resident individual is subject to Australian income tax on a.

The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. With the annual indexing of the repayment incomes for study and training support loans. Individual income tax for prior yearsThe.

Company taxThe company tax rates in Australia from 200102 to 202122. Australian residents pay different rates of tax to foreign residents. In the Australia Tax Calculator Superannuation is simply applied at 105 for all earnings above 540000 in 2022.

If your taxable income is less than 6666700 you will get the low income tax offset. Please contact us if you would like to have additional calculations for. The Personal Income Tax Rate in Australia stands at 45 percent.

There are no changes to most withholding schedules and tax tables for the 202223 income year.

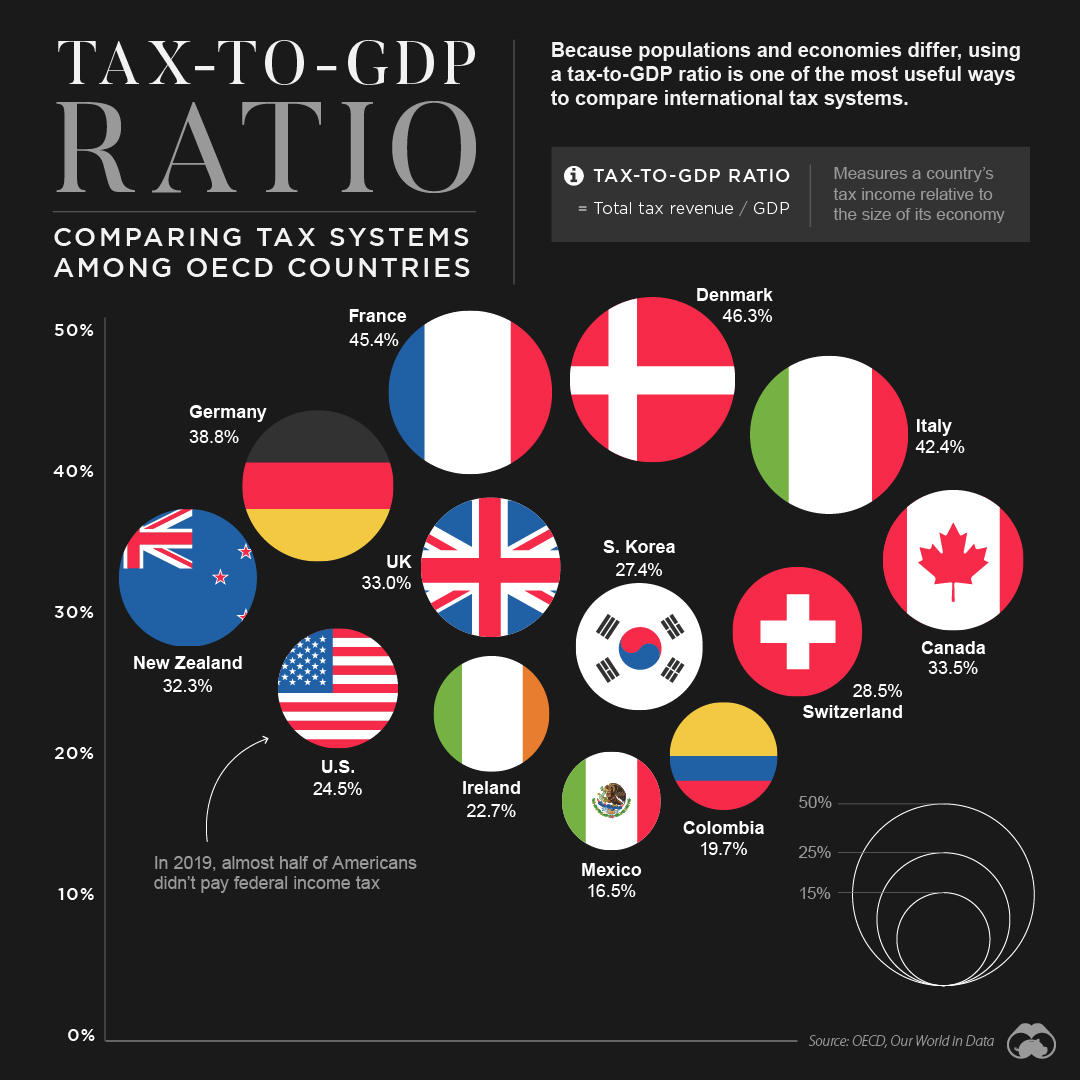

Tax To Gdp Ratio Comparing Tax Systems Around The World

Taxing The 1 Why The Top Tax Rate Could Be Over 80 Cepr

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Working Holiday Visa Tax All Your Questions Answer

How Do Us Taxes Compare Internationally Tax Policy Center

File Tax Rates On Dividend Income In Oecd Svg Wikimedia Commons

Salary Pay Tax Calculator Suburbsfinder

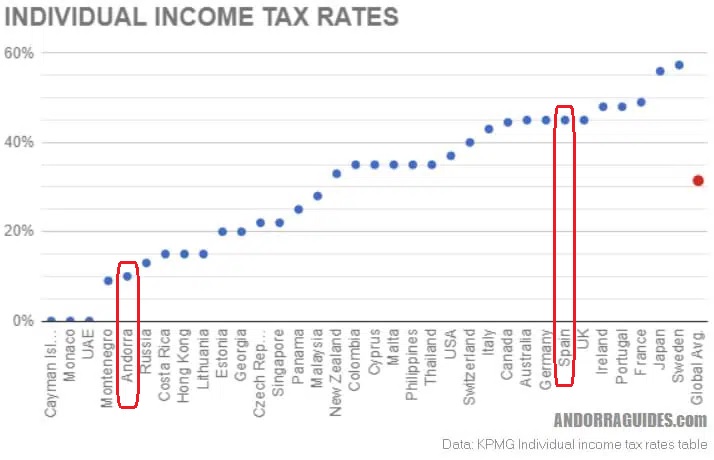

Learning From Andorra S Tax System International Liberty

2020 21 Federal Budget Details What S In It For You

Global Corporate And Withholding Tax Rates Tax Deloitte

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

End Of Financial Year Guide 2021 Lexology

Taxes Income Tax Tax Rates Tax Updates Business News Economy 2022

Your Ultimate Australia Crypto Tax Guide 2022 Koinly