value appeal property tax services

At Fair Assessments we have the knowledge experience and resources to. Ad Find Recommended Georgia Tax Accountants Fast Free on Bark.

You may obtain petition forms by calling 503 846-3854 or go to our Board of Property Tax Appeals BoPTA website.

. In the event of an untimely property. Ad We Guide You Through the Property Tax Work That Slows You Down. Filing a Property Tax Appeal.

Property tax services was founded in 1992 by albert al gay. Property Tax Appeal Process. They can help you assess the true value of your home and file an appeal to reduce your property taxes.

And enhancement of an individual property owners rights when objecting to and appealing an increase made by a county board of tax assessors to the value. If you have value questions you may call 503 846-8826. Find County Online Property Value Info From 2022.

Ad Get Appraisal Information From 2022 About Any County Property. If you feel like your tax. We offer a powerful web based do-it-yourself tool that homeowners use to lower their property taxes.

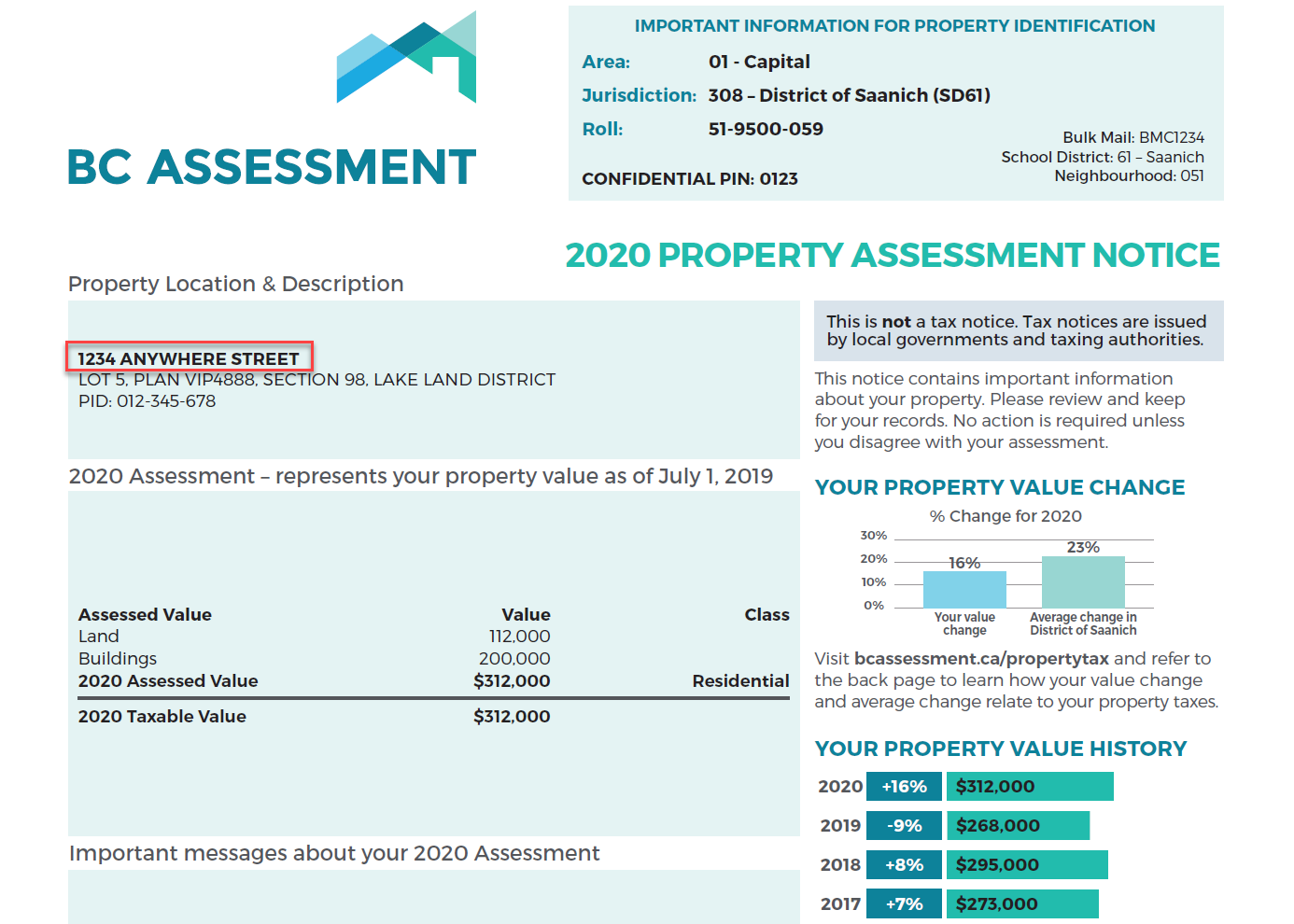

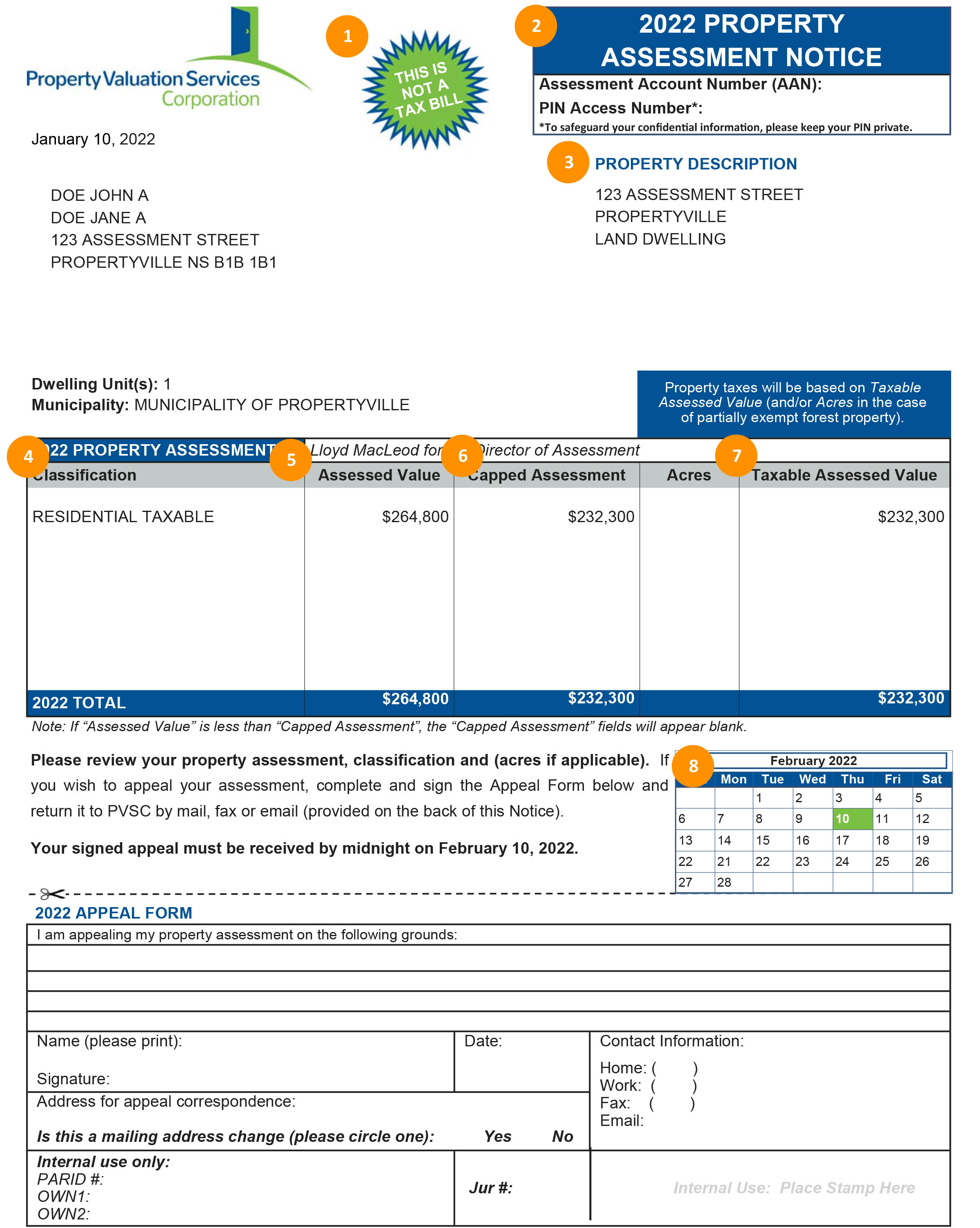

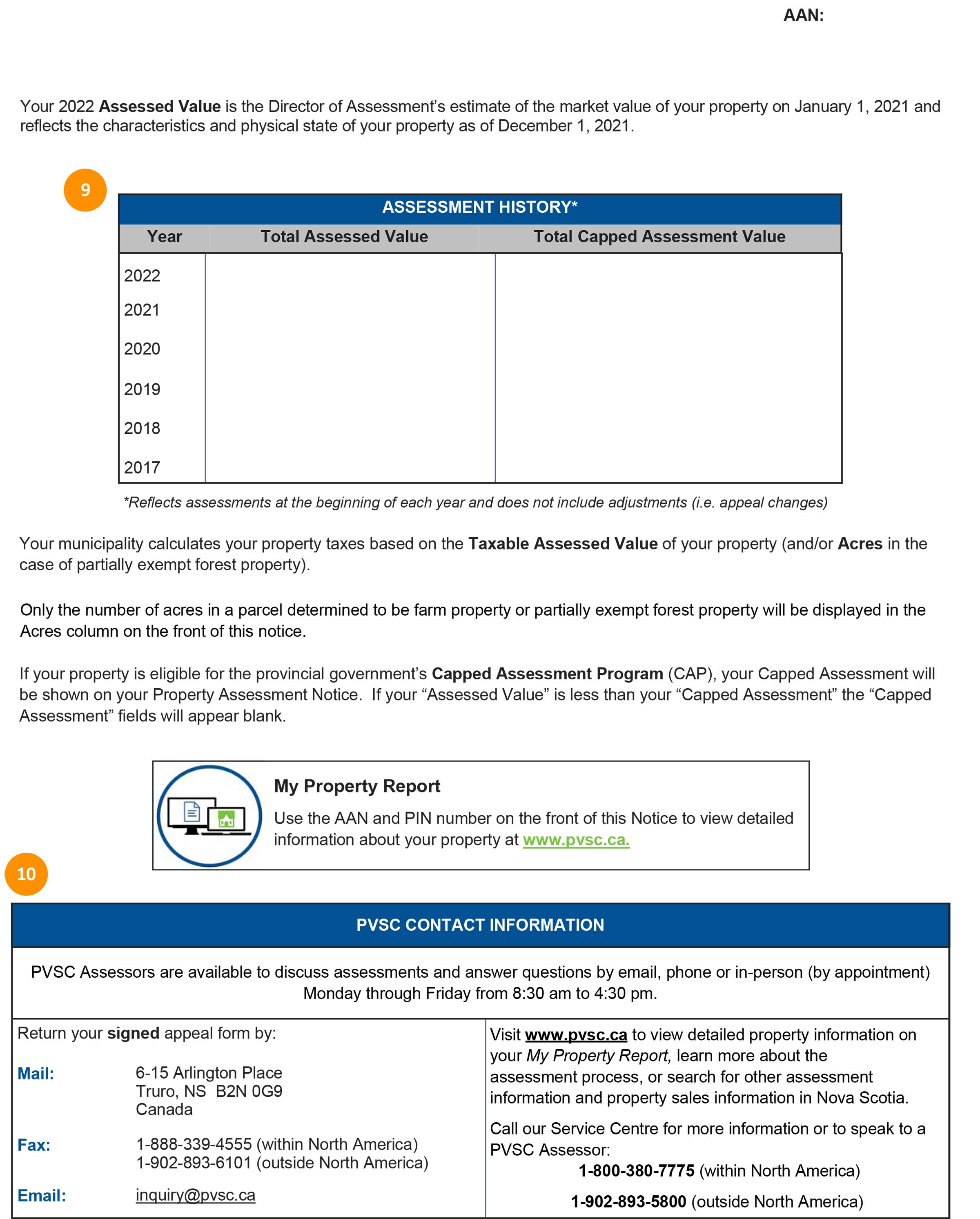

In addition to our appeals service we provide personal property form filing and property tax management services. When to File an Appeal - Within 60 Days of the Mailing Date of your Official Property Value Notice. How are annual property tax assessments calculated in California.

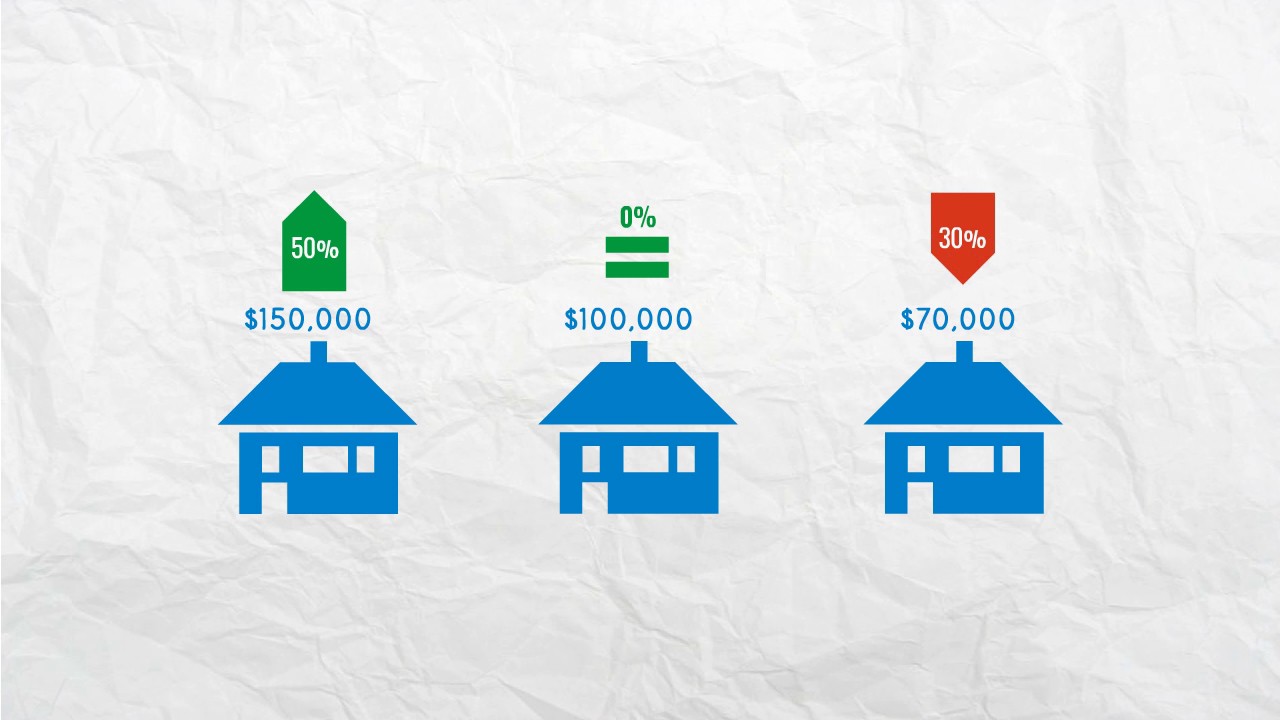

When we compare it to the assessed value and theres a value gap we navigate the property tax appeal. This is where property tax appeal services can come in handy. State your estimate of the value of your property as of January 1st for the year that you are appealing.

We monitor your property values applying our knowledge of. The taxpayer may appeal any. The law has two main thrusts.

Property Tax Appeal Statistics. ValueAppeal is TurboTax for property taxes. There is an appeal process to assist property owners in presenting their concerns about property valuation.

Ad Find Recommended Georgia Tax Accountants Fast Free on Bark. A successful base value appeal is a permanent reduction in assessed value. Property tax appeal procedures vary from jurisdiction to jurisdiction.

Property Taxpayers Bill of Rights. During the year of the reappraisal or any year of the reappraisal cycle a taxpayer may appeal the appraised value of his property. Real estate value appeals may be filed after January 1 and until the adjournment of.

Specify whether you want to be billed at 85 or 100 of the assessed value while. If the assessed value. The Department of Assessments will be mailing Official Property Value Notice 1 cards for the.

As soon as you receive your proposed property tax. Check Your Property Tax Assessors Website. Washington State law requires the assessed value of a property reflect 100 of market value.

Our service provides an easy to understand. Will appeal your high property tax bill with the county value adjustment board. Estimate tax liability and appeal assessment.

Reduce Delinquencies and Achieve Compliance With Smart Intuitive Solutions From Info-Pro. Fair Assessments may lower your residential property taxes by reducing and capping tax assessments. Hoppe Associates specializes in results-oriented property tax appeals.

We analyze value based in fact supported by market data and income potential. To determine tax liability and review assessment of a property property owners depend on the assessors office to accurately determine and. Taxable value of real property is.

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Assessments Banff Ab Official Website

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Assessment Assessment Search Service Frequently Asked Questions

Your Property Assessment Notice Property Valuation Services Corporation

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Your Property Assessment Notice Property Valuation Services Corporation

Writing A Property Tax Assessment Appeal Letter W Examples