prince william county real estate tax payments

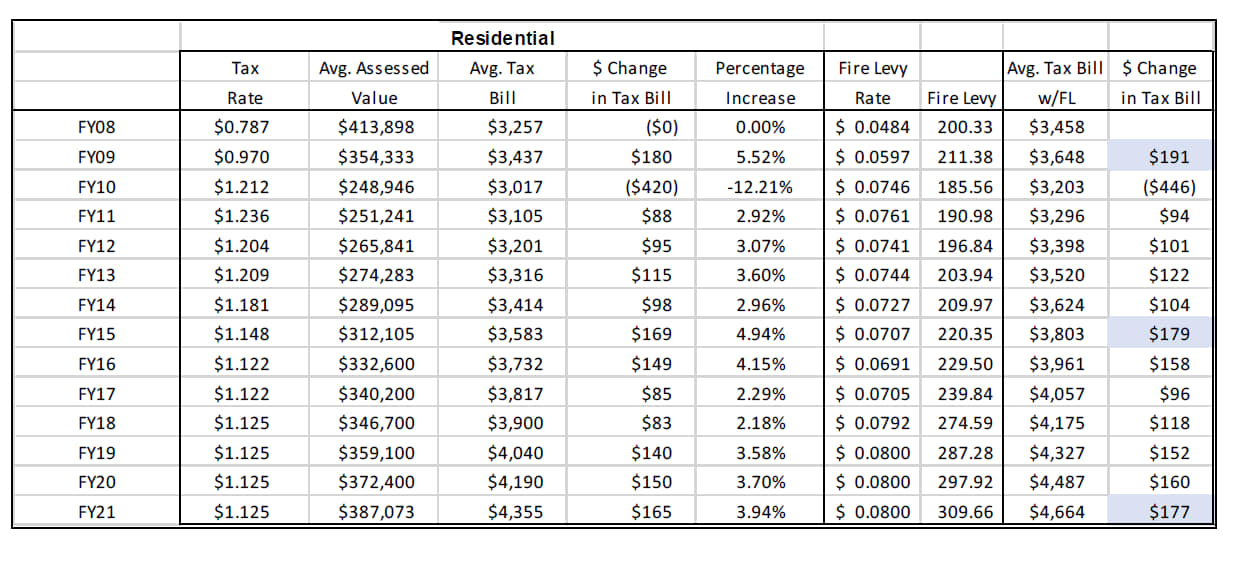

Have pen paper and tax bill ready before calling. 340200 9 hours ago the median property tax also known as real estate tax in prince william county is 340200 per year.

The first monthly installment is due July 15th.

. Prince william county real estate tax due dates. Enter your payment card information. Hi the county assesses a land value and an improvements value to get a total value.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Ad Look Up Any Address in the USA. 340200 9 hours ago the median property tax also.

5 2020 to Feb. By phone at 1-888-272-9829. A convenience fee is added to payments by credit or debit card.

Download Property Records from the State Assessors Office. You can pay a bill without logging in using this screen. By creating an account you will have access to balance and account information notifications etc.

Prince William County Property Tax Payments Annual Prince William County. All you need is your tax account number and your checkbook or credit card. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

You will need to create an account or login. Learn all about Prince William County real estate tax. The extension applies to both commercial and residential real property.

Personal Property Tax Vehicle License Fee. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. Millions of Property Records Are Accessible to the Public.

Press 2 to pay Real Estate Tax. Press 1 for Personal Property Tax. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county.

The system will verbally. Due to the low tax rate. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

During a meeting on Nov. The eCheck system is Prince William County s no-cost automated payment system that allows you to pay real estate taxes personal property taxes and other taxes over. The deadline has been changed from Dec.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. When are property taxes due in Virginia County Prince William. What is the property tax in Prince William County Virginia.

There are several convenient ways property owners may make payments. Payment by e-check is a free service. 00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated.

Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. 17 2020 the Prince William Board of County Supervisors passed a resolution extending the payment deadline for real estate taxes for the second half of 2020 for 60 days. Enter the Account Number listed on the billing statement.

Follow These Steps to Pay by Telephone. Prince william county real estate tax assessment Wednesday June 8 2022 Edit. The due date for 2nd half 2021 real estate taxes is december 6.

What is different for each county and state is the property tax rate. Prince William County Virginia Home. How will i recieve my pets license and annual renewal notice.

Press 1 to pay Personal Property Tax. The second and all subsequent installments are due on the 5th of each month. Prince William County collects on average 09 of a propertys.

Then they get the assessed value by multiplying the percent of total value assesed currently 100. When prompted enter Jurisdiction Code 1036 for Prince William County. Citizens and businesses struggling to pay real.

Where Residents Pay More In Taxes In Northern Va Wtop News View free online plat map for Prince William County VA. Then they multiply that by the tax rate to get your property tax. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone.

Join Renew Realtor Association Of Prince William

Now Accepting Applications Restore Retail Grant Program

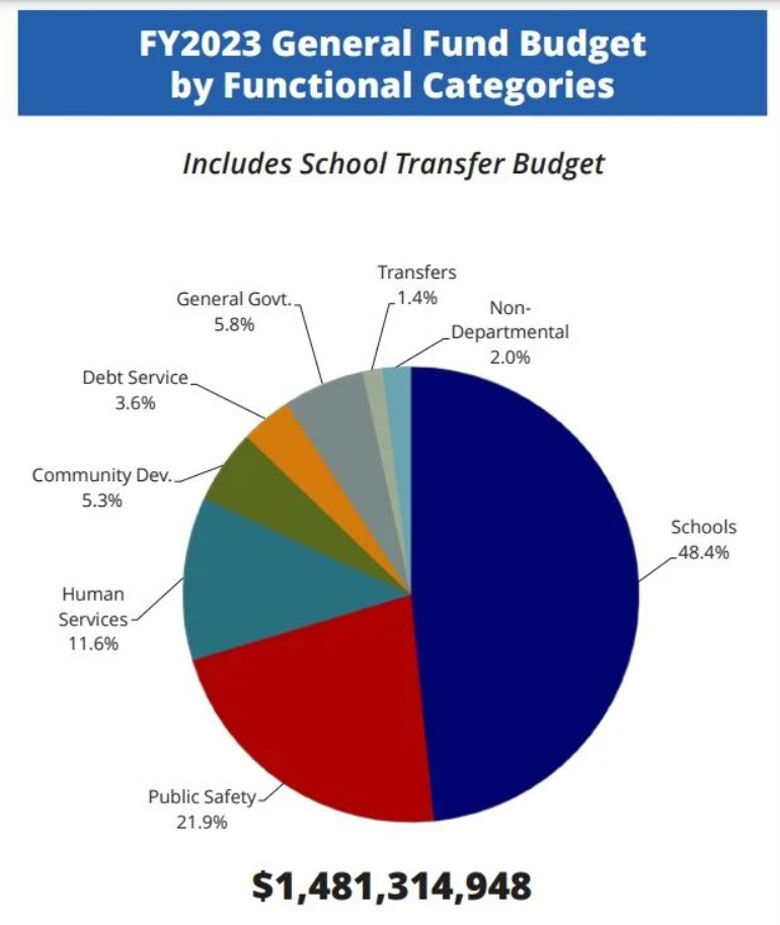

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

The Rural Area In Prince William County

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Class Specifications Sorted By Classtitle Ascending Prince William County

The Rural Area In Prince William County

Prince William County Launches A New Show Called County Conversation

Prince William County Real Estate Prince William County Va Homes For Sale Zillow

Market Statistics Realtor Association Of Prince William

National Park Service Prince William Forest Park Sign Virginia Travel Forest Park National Parks

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

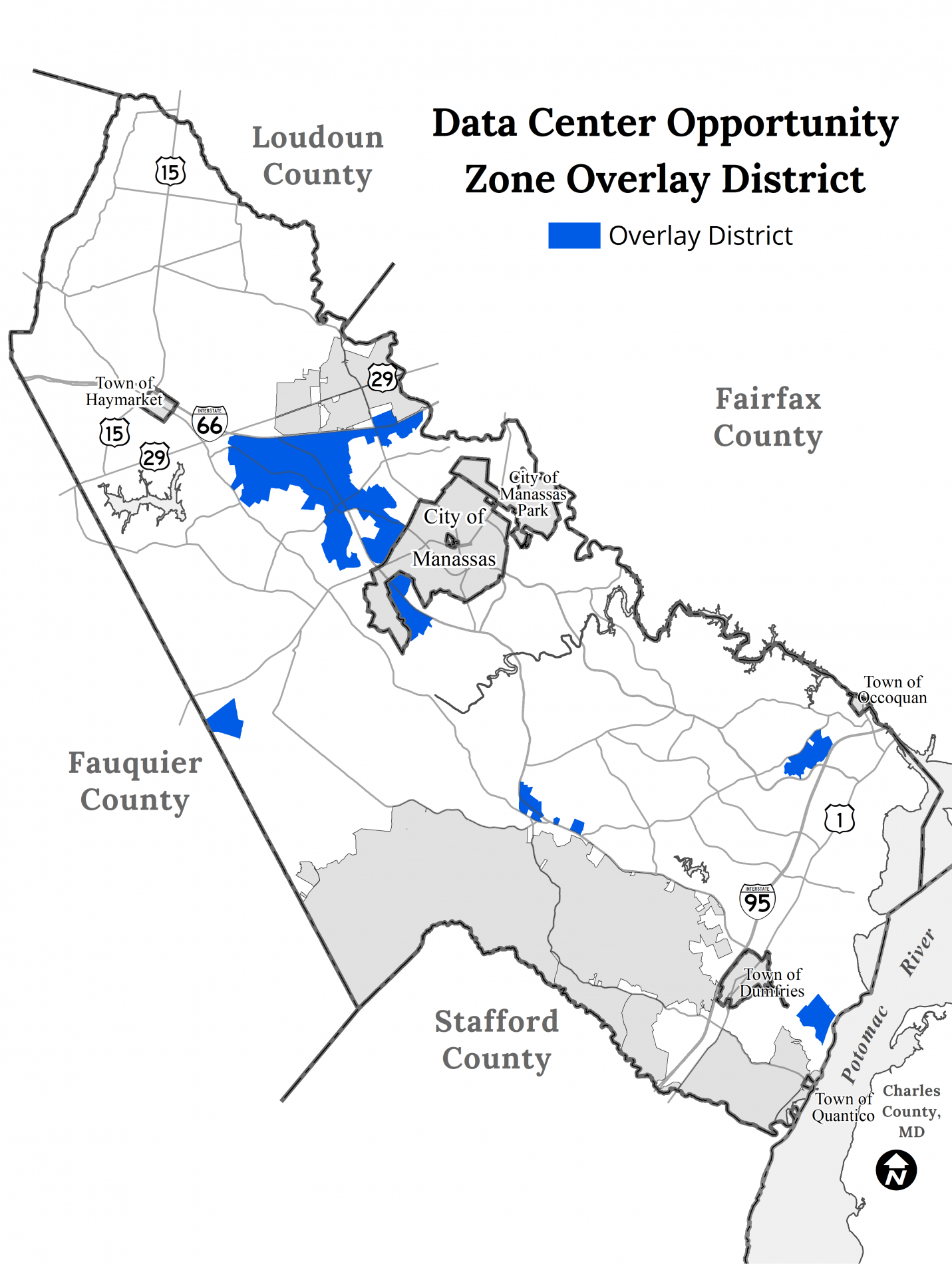

Data Center Opportunity Zone Overlay District Comprehensive Review

Gas Tops 5 A Gallon In Prince William County Northern Virginia Headlines Insidenova Com

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

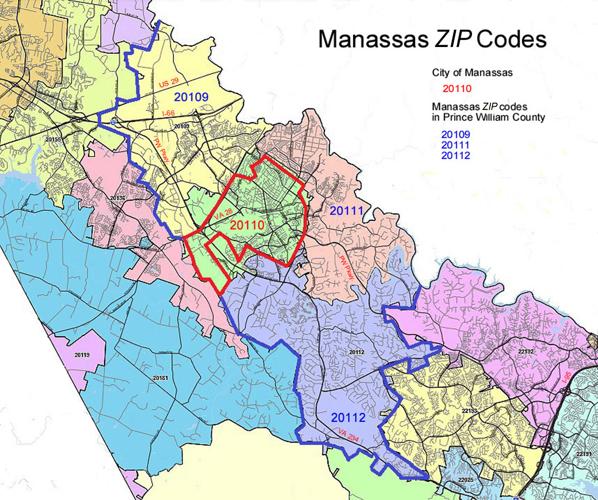

Guest Column When Is Manassas Not Manassas Opinion Princewilliamtimes Com

Prince William Wants To Hike Property Taxes Introduces Meals Tax